working capital funding gap

Working Capital Current Assets Current Liabilities. The working capital financing can come in the form of cash from the business itself an operating loan that is connected to the business bank account and goes up and down as required.

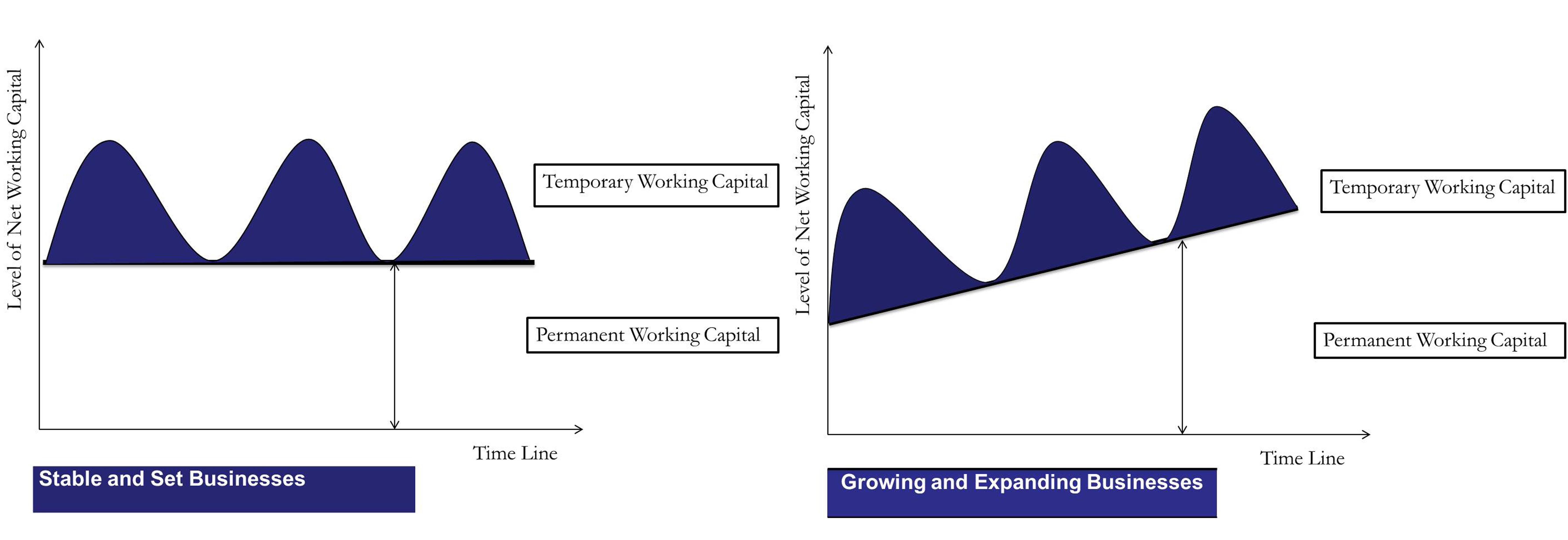

Permanent Or Fixed Working Capital

A decline in sales an increase in past due receivables a temporary increase in labor.

. By substituting 90 days instead of 45 days in the formula used above the working capital requirement doubles to 45000 or 247 of revenue. Typically this decision is reached by the client when it needs to have more working capital for expansion purposes filling the gap in funding. A funding gap is the amount of money needed to fund the ongoing operations or future development of a business or project that is not currently funded with cash equity or debt.

A funding gap is. Funding At Your Fingertips. Stockpile the inventory and make sure they are not out-of-stock Raise the price of the products.

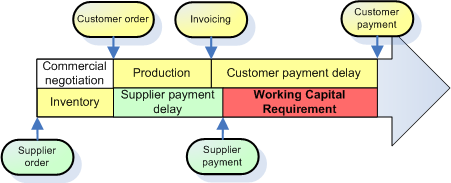

The working capital gap in simple words is the difference between total current assets and total current liabilities other than bank. The amount of finance a business needed to carry out this day to day trading activity is referred to as the working capital requirement or working capital funding gap and. Working capital gap Current assets current liabilities other than bank borrowings For exampleCurrrent if current asset is 100 and current liabilities is 80bank.

Even if the terms are. To accomplish this goal working capital is often kept at 20 to 100 of the total current liabilities. It is a measure.

See the answer What actions could a company take to reduce its working capital funding gap. The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off. Working capital gap Current assets current liabilities other than bank borrowings For exampleCurrrent if current asset is 100 and current liabilities is 80bank.

Ad Business Line Of Credit Powered by American Express with Kabbage. Gap Financing or gap funding loans are. From global corporate bank alignment risk vs relationship the change in technology and implication of cloud.

Ad Turn your outstanding invoices and accounts receivable into working capital. The company therefore opts to sell. Irregular funding and stop-gap measures are the unfortunate.

Zero Working Capital When a company has exactly the same amount of. Find out how banks can bridge. Learn how to get immediate business capital by turning your invoices into cash right away.

Working capital shortages can be created from a number of different business events. Learn about the benefits of Working Capital Fund WCF and how it can help mitigate the impacts of federal funding instability.

Working Capital What Is Working Capital Youtube

Working Capital Financing What It Is And How To Get It

Working Capital Requirement Wcr Agicap

How To Improve Working Capital With Efficient Credit Management

Working Capital Requirement Wcr Agicap

Working Capital Financing What It Is And How To Get It

Treasury Essentials The Cash Conversion Cycle The Association Of Corporate Treasurers

Days Working Capital Formula Calculate Example Investor S Analysis

Working Capital Formula Youtube

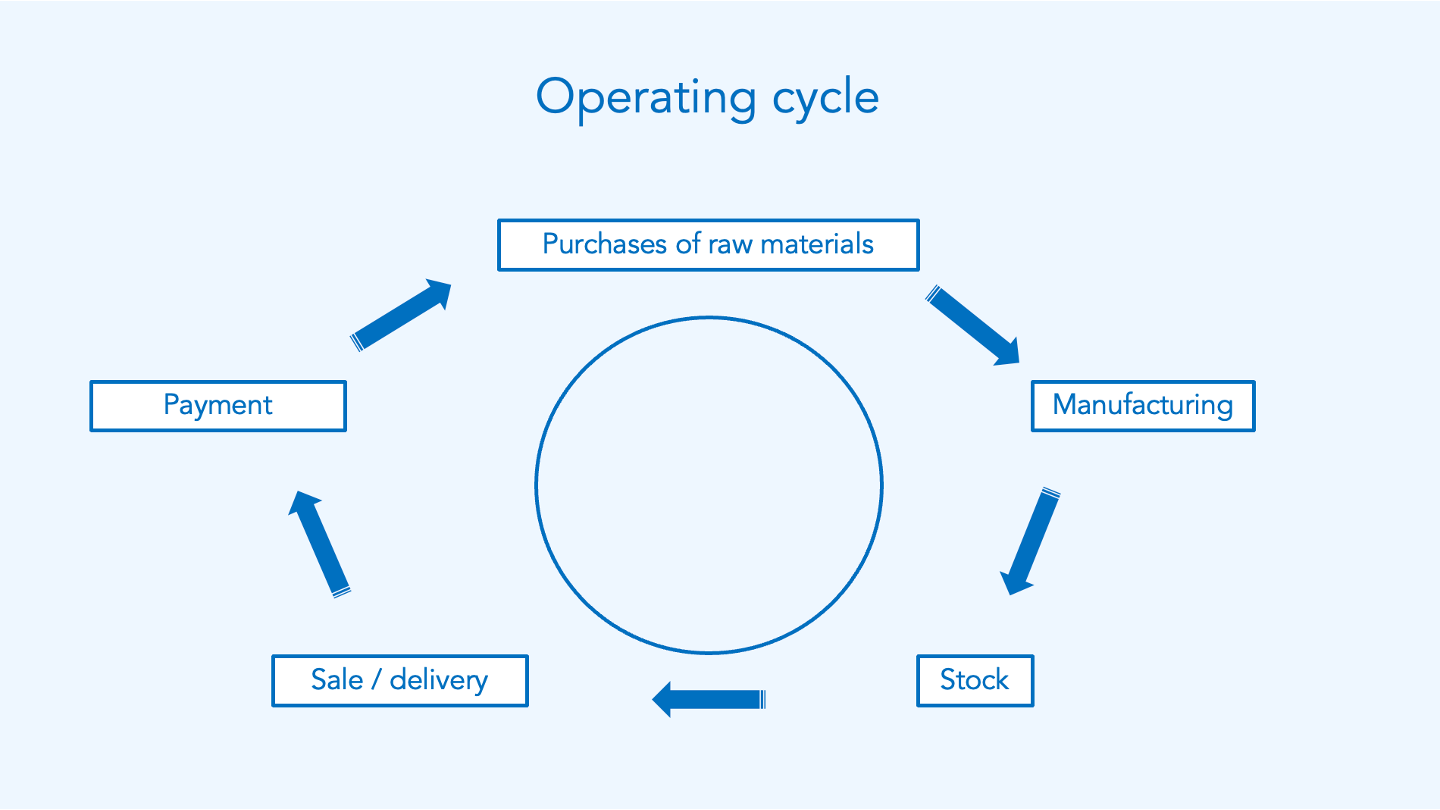

Working Capital Cycle Efinancemanagement

Working Capital Cycle Definition How To Calculate

Types Of Working Capital Gross Net Temporary Permanent Efm

What Is Working Capital Gap Banking School

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

Working Capital What Is Working Capital Youtube

Working Capital Financing What It Is And How To Get It

Working Capital Cycle Understanding The Working Capital Cycle

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)